|

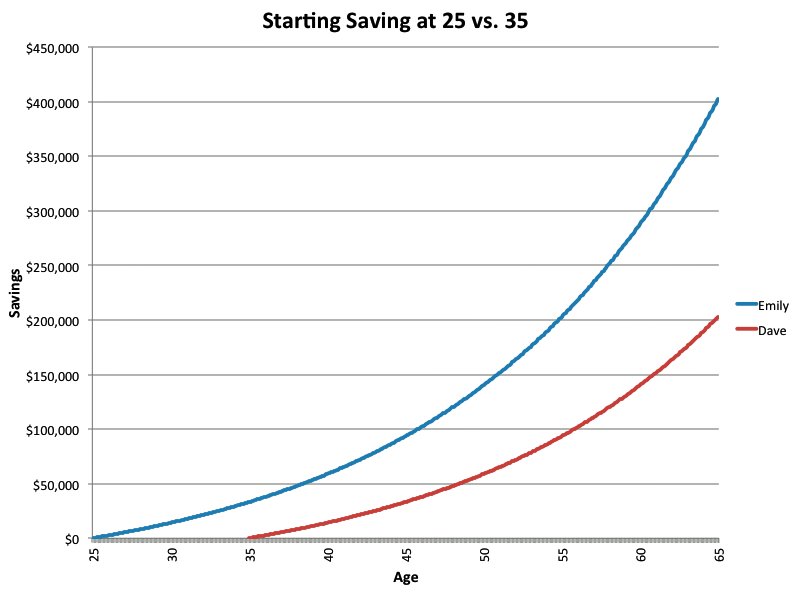

A running theme in my work (and my blog) is that the government encourages activities by providing incentives - something I call "free money" accounts. Retirement contributions are so important that incentives shouldn't be necessary, but since they are available, take advantage of them! Furthermore, many employers match some of your contributions. If you aren't taking full advantage of this match, your are leaving a lot of money on the table. I'm discussing 401ks and IRAs here as if they are the same, but there are different contribution limits for each. For contribution limits - Fidelity has a nice summary - here. Benefit of a retirement contribution A Google search of Google employee retirement plans (correct me if this info is incorrect) revealed that they have 50% employee contribution matching of their 401k. If you invest the 2015 limit of 18,000, you would end up with an additional 9000 in your account from Google. In addition, if you are in the 28% federal and 9.3% state bracket, you avoid taxes on 18,000, or $6714 in savings. Between the match and the tax savings, You get an 87% Return on day 1 of your investment! and you get access to 37% of it right now! Regular vs. Roth Clients often ask me on my opinion on using regular or Roth retirement accounts. Often they don't open an account for months while pondering this question - and have lost out on the benefits of both. My first piece of advice - take advantage of what you can - they are both a great deal. The general rule is that regular accounts take advantage of tax deductions now, and Roth doesn't get taxed when you take it out. If your tax rates are the same now and when you retire, you end up with the same benefit. If they are higher now, the regular retirement account provides more benefit. Of course, no one knows their future tax rates. Smart clients do some of both, which provides them with a hedge of their bets AND tremendous flexibility on retirement income and taxes when they retire. When to invest (straying from taxes for a bit...) Due to the growth of money, retirement contributions early in your career are most important. Check out this chart from Business Insider - at a 6% growth rate, investing $200 a month will yield double the savings if you start 10 years earlier. But this is a blog about taxes - back to the main subject. The two main retirement employer plans are regular and Roth 401ks.

1 Comment

|

Author

Archives

December 2015

Categories |

T 650.342.4394

RSS Feed

RSS Feed