|

Self-employed individuals have more options when funding their retirement. Regular IRAs and Roth IRAs are available - so, for smaller amounts, see the blog below on that topic. 4 options for larger amounts of contributions include SIMPLE IRAs, SEP IRAs, Solo-401ks, and Defined Benefit plans.

Target group for each type of plan

https://www.fidelity.com/retirement-ira/small-business/compare-plans SEP vs. Solo 401k For most of my self-employed clients, the question is usually around SEP or Solo-401k plans. Why is one better than the other if they have the same limits? You can hit the limits MUCH faster with a solo-401k. With both plans, you are permitted an 'employer' contribution of about 20% of your net business income. I say about, because the calculation is a bit more complex. but with a solo-401k, you can also contribute the employee portion of up to $18,000 or $24,000 depending on whether or not you have reach 50 years of age. For example, if your schedule C income was $100,000 this year, you could contribute about 20,000 to your account with a SEP, or (20,000 + 18,0000) to your account with a solo-401k. Why would anyone choose a SEP? I see three reasons:

0 Comments

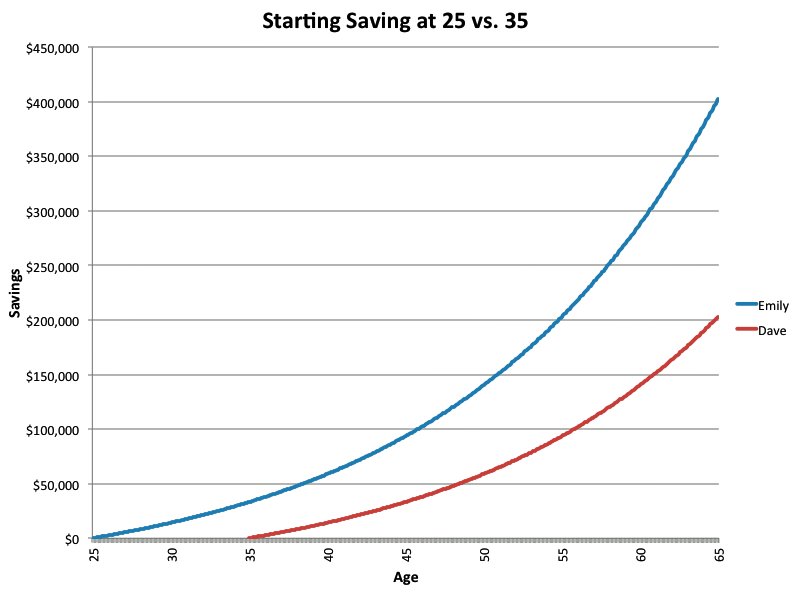

A running theme in my work (and my blog) is that the government encourages activities by providing incentives - something I call "free money" accounts. Retirement contributions are so important that incentives shouldn't be necessary, but since they are available, take advantage of them! Furthermore, many employers match some of your contributions. If you aren't taking full advantage of this match, your are leaving a lot of money on the table. I'm discussing 401ks and IRAs here as if they are the same, but there are different contribution limits for each. For contribution limits - Fidelity has a nice summary - here. Benefit of a retirement contribution A Google search of Google employee retirement plans (correct me if this info is incorrect) revealed that they have 50% employee contribution matching of their 401k. If you invest the 2015 limit of 18,000, you would end up with an additional 9000 in your account from Google. In addition, if you are in the 28% federal and 9.3% state bracket, you avoid taxes on 18,000, or $6714 in savings. Between the match and the tax savings, You get an 87% Return on day 1 of your investment! and you get access to 37% of it right now! Regular vs. Roth Clients often ask me on my opinion on using regular or Roth retirement accounts. Often they don't open an account for months while pondering this question - and have lost out on the benefits of both. My first piece of advice - take advantage of what you can - they are both a great deal. The general rule is that regular accounts take advantage of tax deductions now, and Roth doesn't get taxed when you take it out. If your tax rates are the same now and when you retire, you end up with the same benefit. If they are higher now, the regular retirement account provides more benefit. Of course, no one knows their future tax rates. Smart clients do some of both, which provides them with a hedge of their bets AND tremendous flexibility on retirement income and taxes when they retire. When to invest (straying from taxes for a bit...) Due to the growth of money, retirement contributions early in your career are most important. Check out this chart from Business Insider - at a 6% growth rate, investing $200 a month will yield double the savings if you start 10 years earlier. But this is a blog about taxes - back to the main subject. The two main retirement employer plans are regular and Roth 401ks.

School is expensive. Thankfully, there are a few deductions and credits to help offset these costs for schooling at some levels.

There's help for preschool for working parents, donations to education foundations, college, and education for disabled students. There isn't a lot of help directly for private elementary through high school education, but some planning can provide a bit of help. Presumably, Congress wants you to rely on public schools. Preschool: If both parents work (or a single parent works), preschool can be treated as dependent day care. See my post below related to dependent day care. Take advantage of dependent care pre-tax programs through your work if available, as well as the dependent care credit. College: You can claim up to 4 years of the American Opportunity Credit per student, worth $2500 per year. Parents may claim it for dependent students - but there is a phaseout and it caps at $180,000 per year. If you are beyond year 4 or in grad school, the Lifetime Learning credit is available to you. This is worth $2000 per year, but there is a lower phaseout, capping at $124,000. Only tuition and fees are used for the Lifetime Learning Credit, but books and other expenses (not room and board) are available for the American Opportunity Credit. 529 Plans may be the best tax-advantaged way to save for college. They work similar to Roth IRAs - there is no tax break for putting money into a 529, but you pay no tax on the earnings as long as the money is used for college. There is a provision to gift 5 years worth of 529 contributions at once. Elementary through High School My daughter is heading off to a public elementary school. Unfortunately, our school system is not funded well enough to provide some of the basics, like PE, music, or art. A foundation has been set up to solicit donations to cover these programs. This foundation is a 501(c)3 nonprofit, therefore my donations to the foundation are deductible. Special needs education is deductible if it meets certain tests. The primary purpose of attending the school must be to alleviate the handicap through the school's resources. There are a few other requirements as well. Lodging, meals, transportation, and tuition would all fall as a medical deduction (subject to either a 10% or 7.5% AGI floor). Private education is generally not deductible. There are a few tax-advantaged opportunities which may indirectly help. If a person other than a parent is funding the tuition, that person can pay the tuition directly to the school and avoid gift tax limits. UTMA accounts have some benefit for funding private education as well. UTMA accounts are simply accounts in your child's name, but the person setting up the account can control the money until age 18 (in California). There's no specific tax break to UTMA accounts, but they take advantage of the fact that the first $1000 in unearned income per year is tax-free. So, if you were going to invest an amount which will earn less than 1000 per year, you would get some savings with an UTMA. This of course may be a drop in the bucket for private education costs. As always, email me if you have any questions on these topics. I'm Hiring a Nanny (a nurse, a gardener, a maid...) do I need to give them a W-2 and withhold taxes?8/7/2015 There are specific rules regarding whether a 1099 or a W-2 is needed, and it often comes down to the level of control you have over the individual. You to use the following factors to determine whether you have hired an employee or independent contractor.

Its often not clear cut - but nannies are often employees when you add it all up. Gardeners, not so much. Why does it matter? Payroll taxes are expensive, and the cost of running payroll is expensive too. You can handle it yourself, but most end up using a payroll service. In addition to payroll and taxes, there are additional compliance concerns. Household Payroll Procedures Federal household payroll taxes are handled on your income tax return, but you will need to handle the state taxes separately (or through a service). If you pay $1900 in a year, or $1000 a quarter, you will file Schedule H with your 1040. On this schedule, you report Social Security (12.4%), Medicare (2.9%), and FUTA (0.6% of the first 7k). You can withhold half of the social security and medicare from the nanny pay, however, if you agreed with the nanny on a flat amount, you may end up paying the full amount of payroll tax yourself, raising the cost more than 15%. For California, the threshold is $750 a quarter. If you pay more than $20,000 a year, you move from annual reporting to quarterly reporting. There are specific payroll tax forms for California. The state taxes aren't high, but there are several of them (SDI, UI, ETT). If you determine that you are hiring an employee, I'd recommend that you contact a payroll service to help you with the paperwork. If both spouses are working or going to school, or you are a single parent who is working, the dependent care credit AND a pre-tax dependent care program at work may be available to you. Dependent care expenses include nanny, day care, after school programs and day camps. The social security number or EIN of the provider must be reported. If your employer has a $5000 pre-tax savings program for dependent care, max this out first if you are at least in the 25% tax bracket and you have at least 5k in dependent care expenses. The dependent care credit is for expenses of $3000 per child, $6000 per 2 or more children, but you have to reduce this amount by anything put into the pre-tax program at work. For most taxpayers, the credit is 20% of expenses, or a maximum of a $1200 credit for 2 or more kids. Lets see how this plays out with a few examples. In previous posts, I introduced you to Tobias and Linsdsay who are in the 28% marginal tax bracket. If Lindsay has a pre-tax program available, she could put in $5000, saving her $1400 in tax. If she opted for the credit, her credit would only be $600. Lindsay’s parents George and Lucille had four children – Lindsay, Michael, and George Oscar Bluth II, and Buster. The parents are in the 33% marginal tax bracket. Assuming both George and Lucille received paychecks from the family company, and they had more than $6000 in dependent care expenses, they would be eligible for a $1200 dependent care credit for two or more children. However, there is a better way. Since their company offers the pre-tax program, they should max that out first at $5000, saving $1650. They can take the remaining portion of the dependent care credit (6000-5000) = 1000, it’s a 20% credit, so they would receive an additional 200, upping their total savings to $1850. Summary If you have access to a dependent care savings program through work – take advantage of it. If you have two or more kids, you can take this AND a portion of the dependent care credit. From experience, having children is more of a game-changer in your life than anything else. For this post, I’m just going to focus on the tax questions.

1. Should I rush out and change my withholding? You or your spouse (not both) might be able to claim one more allowance. I would only change withholding if you know that you are withholding too much or too little – from a pro’s calculation, or from your tax refund. Often people have kids at a point in their lives that they have increases in income which may offset the tax benefits of children. 2. What does a dependent count as on your tax return? In 2015, the exemption is $4k, so, your tax savings is $4k multiplied by your marginal (top) tax rate for federal and state. For most, that means a savings of about $1,000. HOWEVER – if your combined income is more than $300,000, the personal exemptions start to phase out. 3. Does my filing status change? If you are married, no. If you are single, you now file Head of Household – which is much better. More on this in another post. 4. What about the child tax credit? The child tax credit is separate from the exemption, and is worth $1k per child. It’s a credit, so you get this, dollar for dollar. However, the phaseout starts at $110k of adjusted gross income, and phases out quickly. 5. Can I write off expenses for my Nanny/preschool/sitter etc.? Some, if both spouses are working, and need the care to work, go to school, or look for work. Your employer may have a $5000 pre-tax savings program for dependent care. Max this out first. You can claim a portion of the dependent care credit as well. More on this in the next post. Example Lets return to our example of Tobias and Lindsay. After the birth of their daughter Mae, their $4k additional exemption will save them $1120 in taxes in the $28% bracket. Based on this, they could add one allowance. They will be ineligible for the child tax credit due to the income phaseout. Summary Children will increase the number of personal exemptions, make you eligible for the child tax credit, and potentially the dependent care credit. The personal exemptions and child tax credits do phase out though. Don’t change your withholding by much unless you are sure of the consequences. I often get asked about the tax consequences of getting married. I hope this post answers a few of them. People often rush off to adjust their withholding allowances from Single-0 or 1 to Married 2 right after they get married. Don’t. This is often too much of a change, leading to clients owing tax. Instead, have your paychecks evaluated to determine how much your withholding should change, if at all. Or, you can stand pat and see if you need to adjust after a year or two.

Why do the withholding tables not work like they should? They were designed in another era, when it was less common for two spouses to work. If a wife quits her job right after getting married, then the tables make more sense. Consider the case of a fictional couple, Tobias and Lindsay. Before getting married, Tobias was earning $100,000 as a therapist, and Lindsay was collecting a $100,000 a year from a family company. They did not own the home they lived in, so their tax situation was fairly simple. They would have each owed 18,500 in tax, before withholding, Or $37k combined. If they were married, they would owe 37,866 – for them, there’s an $866 marriage penalty! Something funny happens with the tax rates after you make 75k individually – below that, the married tables are exactly double the single tables, but after that, the tax rates move up faster for married individuals. Why? You can come to your own conclusions. What’s worse is that Tobias and Lindsay both rushed out to change their withholding from Single -1 to Married – 2. At Single – 1, their withholding was 19,585 – they each were headed to a 1k refund. At married – 2, their withholding is all the way down to 13,303 each, 26,606 combined. Suddenly they owe over $10k in tax! If they left their withholding alone, they would have enough to cover the tax. Moral of the story, don’t rush out to change your withholding. On newer W-4 forms, the single box will also say Married 2 incomes, and this makes sense. A challenge in tax planning is that you don't know what Congress will do with taxes in the future. Its hard to say what taxes will look like for 2015 when we weren't sure what taxes would look like for 2014 until yesterday (with 2 weeks left in the year!) Congress renewed a series of extenders (tax breaks) for a one year term yet again - ensuring very little change from last year. The items which didn't make the cut don't affect the individual or the average small business.

One new interesting provision is in place - ABLE accounts. These will work like 529 accounts for expenses for qualified disabled individuals. Contributions will not be deductible, but the accounts can grow tax-free if used for qualified expenses. Last week I talked about tax planning when income is the same or higher than usual. This week i'll focus on what to do when income is lower than normal. Why do anything if your taxes will already be low? Well, you may be able to save a lot of money in the long-run if you are thinking beyond this year. You may be able to take advantage of 0% or 15% rates instead of 28-39.5% in the future.

Step 1: Know your tax position: Sound familiar? see part 1 to familiarize yourself with this step. Step 2: Take Action. If this year's income is low: There are options to shift some of your income or expenses, or roll over IRAs. Shift income into the current year, and delay expenses - If you recognize income in December instead of January, you have changed your tax position. Likewise, you may be able to make a deductible expense payment in January instead of December. Consider selling some of your appreciated stock - If you are married and make less than 72k, capital gains are now at 0%. This may be chance for you to recognize some of your gain. Rates may not be this low forever. Sell IRAs or Roll IRAs into Roth IRAs - By rolling over your IRA into a Roth IRA, you will recognize income in the current year, but the money will not be taxed again. This is perhaps the easiest way to recognize income sooner. I have a successful client who decided to take 2014 off and live in Paris. Without the day job, her income is way down, so she is rolling some of her IRA into a Roth IRA this year, taking advantage of the low rates. Another client is elderly and in a nursing home, but with large IRAs. Rather than just taking out the required minimum amount, he is withdrawing larger amounts each year, so they can be taxed at his low rate. His children will inherit cash rather than an IRA being taxed at 28% to them. Summary: Effective tax planning involves taking into account your current tax position, where you may be in the future, and possible changes you can make. Every tax situation is unique. The tax code is littered with limitation and exceptions, but these basic concepts will help over time. If you want to find out just how much you can save, talk to your tax specialist. Year-end tax planning is not just reserved for the wealthy. Most of us could benefit from a little year-end planning. I’ll review the concept at a high level and give you a few ideas to bring to your accountant or do yourself. December is a good time to evaluate your tax position and make adjustments. Aside from the suggestions below, you can work with an accountant in December to make sure you have paid in enough tax during the year to cover your liability. You can’t take any one of these suggestions individually – you need to think about how each one affects your whole tax picture.

Step 1: Know your tax position. Basic tax planning is about paying less tax in the long run, not over a single year. Before year-end, try to gauge whether your income is the same, higher, or lower than upcoming years. You are better off planning around your income than trying to guess at future tax legislation – as of the date of this post, tax extenders for the current year haven’t even been passed. Step 2: Take action. If your income is the same or higher than normal: You don’t really want to earn less money, of course. You can make some of your income tax-deferred, or you may be able to change the timing of your income and expenses if your job is flexible or you are self-employed. Defer taxable income – Maximize your IRA and 401k or SEP accounts. I’ll cover these in more detail in future posts. These accounts essentially move your current income out of this year into a future year when you are retired. Delay income – This is a bit easier if you are self-employed. If you have the option to receive payment in December or January, think about your tax position and receive the payment in January if it makes sense to move the income into another tax year. Accelerate expenses – Business expenses, medical expenses, and other deductible expenses are recorded on the tax return in the year you pay them. This gives you the flexibility to reduce your income by paying expenses earlier. In California, property tax is a good example. You can pay both halves of your property tax payment in December, rather than in December and April. Then, if you need to delay expenses in another year, you can split them up again. Give to charity – This is recorded on the tax return as an itemized deduction. You can time your gift to offset high income. As I do every year before the holidays, I just donated old toys today to make some room. Harvest capital losses – If you have high capital gains, you may want to sell stocks with losses to offset some of these gains. If your income is lower than normal – stay tuned – that will be the topic of my next post. |

Author

Archives

December 2015

Categories |

T 650.342.4394

RSS Feed

RSS Feed